All Categories

Featured

Table of Contents

With recognized financier demands, capitalists are protected against from spending past their means. If an inadequate investment choice is made, theoretically a recognized capitalist has greater financial means to absorb the losses. Unregistered exclusive securities might have liquidity restrictions; such safety and securities may not be able to be sold for a period of time.

Capitalists have to represent their finances honestly to providers of protections. If an investor states they are a certified investor when they aren't, the monetary firm can refuse to market safety and securities to them. Comprehending what qualifies a capitalist as certified is important for determining what types of safeties you can purchase.

Value Accredited Investor Opportunities

The demands likewise advertise innovation and progression via added investment. Despite being certified, all financiers still need to perform their due persistance during the process of investing. 1031 Crowdfunding is a leading property investment platform - accredited investor property investment deals for alternate investment lorries mostly available to certified investors. Approved investors can access our choice of vetted financial investment opportunities.

With over $1.1 billion in protections offered, the management group at 1031 Crowdfunding has experience with a variety of financial investment structures. To access our complete offerings, register for an investor account.

PeerStreet's goal is to level the playing field and permit individuals to accessibility real estate debt as an asset class. As a result of regulatory demands, we are needed to follow the SEC's policies and permit just accredited investors on our system. To much better educate our investors concerning what this means and why, read listed below to find out about these federal legislations.

Accredited capitalists and certified capitalist platforms are deemed a lot more sophisticated, with the ability of handling the threat that some safeties present. This rule also relates to entities, that include, banks, partnerships, companies, nonprofits and depends on. PeerStreet is taken into consideration a "exclusive positioning" investment possibility, unlike government bonds, and hence based on a little different government plans.

Five-Star Passive Income For Accredited Investors

These governing criteria have roots that go far back right into the evolution of America's financial market. The Securities Act of 1933, just four years after the stock market collision of 1929 and in the thick of the Great Anxiety, made particular specifications concerning just how protections are marketed.

If you're looking to construct and expand your investment profile, consider financial investments from business property to farmland, a glass of wine or fine art - accredited investor real estate investment networks. As an accredited investor, you have the possibility to designate a part of your profile to more speculative asset courses that use diversification and the potential for high returns

See All 22 Products If you're an accredited financier looking for brand-new chances, think about the adhering to diversified financial investment. Yieldstreet specializes in financial investments in genuine estate, lawful settlements, art, financial tools and shipping vessels. Yieldstreet is among the very best property spending apps for those thinking about realty and alternative investments who have a high total assets, with offerings for accredited and nonaccredited investors.

Masterworks permits capitalists to own fractional shares of fine art. Masterworks gives you the alternative to expand your portfolio and invest in blue-chip artwork while potentially gaining earnings from 8% to 30% or even more.

Most Affordable Passive Income For Accredited Investors

This opportunity comes with all the advantages of various other alt investments on the checklist, such as diversifying your portfolio to protect versus supply market volatility. Vinovest has actually shown earnings of 10% to 13% each year in the past.

An accredited financier has an unique status under economic law legislations. Each country specifies specific needs and regulations to certify as a certified investor.

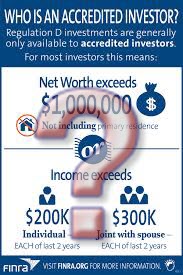

Recognized financiers in the United state should satisfy at the very least one demand concerning their internet worth or earnings, property dimension, governance condition or specialist experience. This demand includes high-net-worth people (HNWIs), brokers, trusts, banks and insurer. The United State Securities and Exchange Commission (SEC) defines the term approved investor under Regulation D.

The idea of marking recognized financiers is that these people are thought about economically sophisticated sufficient to birth the risks - accredited investor crowdfunding opportunities. Sellers of non listed protections may just market to certified investors.

Unparalleled Accredited Investor Crowdfunding Opportunities for Accredited Investors

The web worth might be integrated with a spouse or companion. You could likewise fulfill SEC specialist standards. Find out more on how to become a recognized capitalist here. A number of investment choices for certified capitalists, from crowdfunding and REITs to hard money finances. Right here's what you can take into consideration. Crowdfunding is an investment opportunity growing in appeal in which a firm, private or task seeks to increase needed funding online.

The role of the syndicator is to search and secure properties, manage them, and attach financial investment agreements or pair capitalists. This procedure streamlines real estate financial investment while providing accredited capitalists outstanding financial investment opportunities. REITs pool and look after funds purchased different realty residential properties or real-estate-related activities such as home loans.

Latest Posts

Tax Foreclosed Properties For Sale

Tax Lien Real Estate Investing

Auction Foreclosure Tax